How does the cashback work?

Generally cashback is a reward which the bank returns for card spending. A post-payment discount that you get some time later. There are different types of cashback, but there are certain unified rules that apply to any of them. So, a little bit of terminology.

First, the cashback amount. For each successful transaction you can have either a set percentage returned, or the bonus amount may be dynamic and depend on your overall spending during the accounting period (for $2k you get 1% and for $5k you get 2% returned and so on). Some banks offer elevated bonuses for certain purchases, like at partner stores.

Second, the bonuses you receive as “cashback” may vary as well. Obviously, the bank or other financial institution may give you some money back. Second option is that you receive some kind of bonus points which can be either converted to fiat money (not always at 1:1 rate though) or be used to get a discount at partner merchants. Another one common option is getting your money back as flight miles. The bonuses may be returned as discount points at certain merchants, for example “buy 5 coffees and get 6th for free”. That does count as a rewards, though this is not really cashback as is. More like a loyalty program to stimulate future purchases.

How can banks and MSBs afford cash-back reward programs?

To understand this one there is an explanation owed about how financial institutions earn money. When you purchase something either online or offline, merchants through their corporate bank request a certain amount of money from your bank account. If you have the needed amount on your card balance, it is authorized and credited to the merchant’s bank account later, the whole transaction processing may take up to a week. To pass this information along payment networks (VISA, Mastercard, AMEX) take a small fee from your bank. And the financial institution the merchant has his corporate account at takes around 0,5% for each transaction too.

So, when the money service business may lower these fees for themselves, by conducting partner agreements with certain merchants (or there are several other options), they can refund a percentage to their customers. Moreover, various financial incentives are great marketing tools for both B2B and B2B companies.

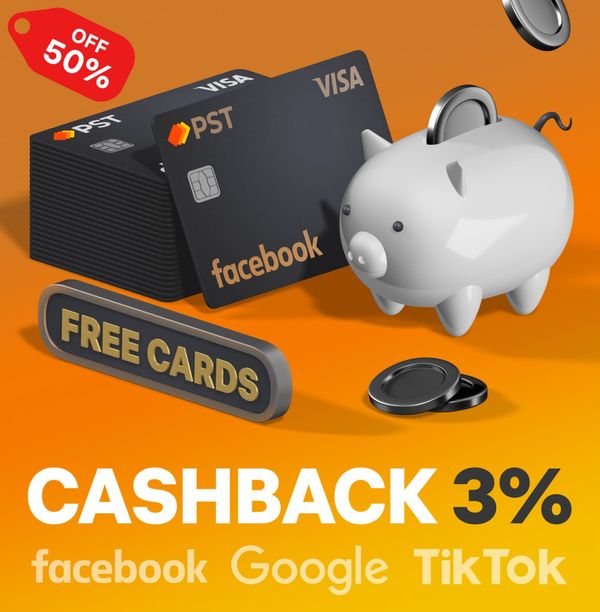

What cashback rewards does PSTNET offer?

PRIVATE program cashback offers lower top-up fees and solid reward percentage rate of 3% for all advertising spending. To date there are 3 subscription tiers, each one with its own maximum bonus limit.

How is this offer more beneficial than the old Private program? First, new PRIVATE is accessible to every user without the need to confirm your monthly turnover. Second, if you look closely, the cashback amount is equal to top-up fees on most of the pricing tiers. Which not only makes your financial analytics easier, but maximizes ROI in all ad campaigns you run by 10-30%. And last but not least, you get access to all 40+ card types, API access and more.

How do you count the cashback reward?

Our clients receive a stable 3% for all advertisement spending from advertisement cards. All spending from Ultima card and non-advertisement spending on other cards are not refunded as a part of the cashback program.

There is a minimum transaction amount of $4 for bonuses to be credited, so the minimum cashback amount is $0.1 and above.

When will I get my cashback?

Accounting period at PSTNET is 30 days, so the cashback is credited to the USDT account at the end of this timeframe. If the cashback amount is sufficient to cover next month subscription fee, it will be used to cover next PRIVATE month.

If you had your subscription plan upgraded during one accounting period, already earned cashback amount will be counted towards new accounting period. And you receive the whole bonus 30 days after the update.

In case of subscription downgrade (which we don’t have to date but it will be there), you receive the bonuses the same day you downgrade.

Where can I look up my cashback rewards?

Earned incentive can be found on the Payments screen and in Finance tab. Please note that rewards are credited only after the transaction is settled, which usually takes no more than a week from the authorization date.

If you’re not PRIVATE subscriber, you may encounter “potential cashback” information on your dashboard. This information is displayed for informative purposes only, as you won’t get all that as soon as any subscription tier is purchased.

To know more about subscription tiers and all the rewards you can earn with PSTNET either visit PRIVATE page or contact our sales team through Telegram, WhattsApp or email to boost your ROI up 10-30%.