1. What is a Bank Identification Number (BIN)?

Every debit or credit card has a unique identification number called a Bank Identification Number (BIN) on the frontside. This number contains information about the issuing bank, card brand, and other essential details. In simple terms, BIN is the first six to eight digits of your card number, which can help identify your card issuer and relevant attributes. In this article you will learn how the PSTNET service can help you verify and validate BIN numbers for your debit and credit cards with an advanced BIN Checker called Pulse.

In terms of affiliate marketing, BIN plays a crucial role for anyone running digital ads. In simple words, Facebook, Google and other tech giants have a security system based on BIN analysis. If any card’s BIN is associated with some unwanted activity (like political provocateurs, spammers and affiliate marketers, especially users of threshold accounts), any advertising account with such payment cards attached will likely end up getting risk-payment ban, and it doesn't matter that the card itself may be brand new. That is why VCCs with trusted BINs are so valuable in terms of digital advertising.

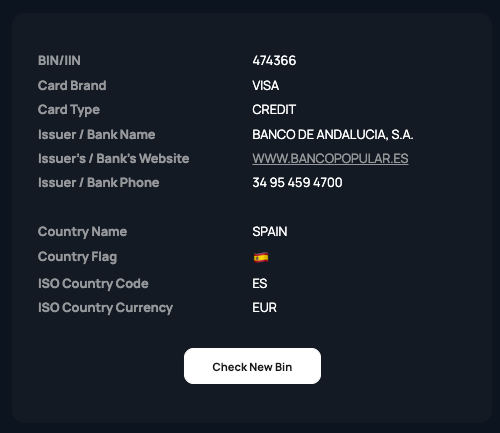

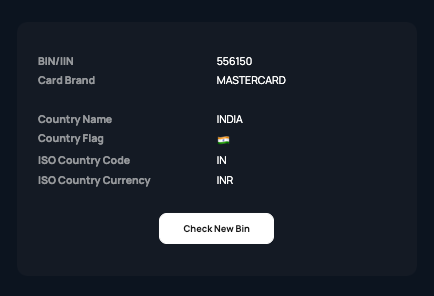

For example, from such 6 digits like BIN 456736 we can get info that this is a Visa Debit Prepaid card, issued in UK, from BIN 556150 – that this is a card issued in India, and from BIN 516180 – that bank called WIRECARD CARD SOLUTIONS LIMITED (UK) issued this Mastercard debit card with Prepaid Business status. Let’s dive a little bit more in what info each BIN can contain.

2. What is a BIN Checker?

A BIN Checker (also known as bin code checker) is a tool that allows users to verify, validate and check a card's BIN number. It is an essential tool in the world of digital payments, as well as digital marketing, as it helps to get nearly all the information about the payment card, thus, understand whether this payment method is suitable for the exact needs.

There are multiple free BIN lookup services that allow you to get basic info on any card, so let’s look closely at what to look for in the BIN details.

3. What are the uses of BIN Checker?

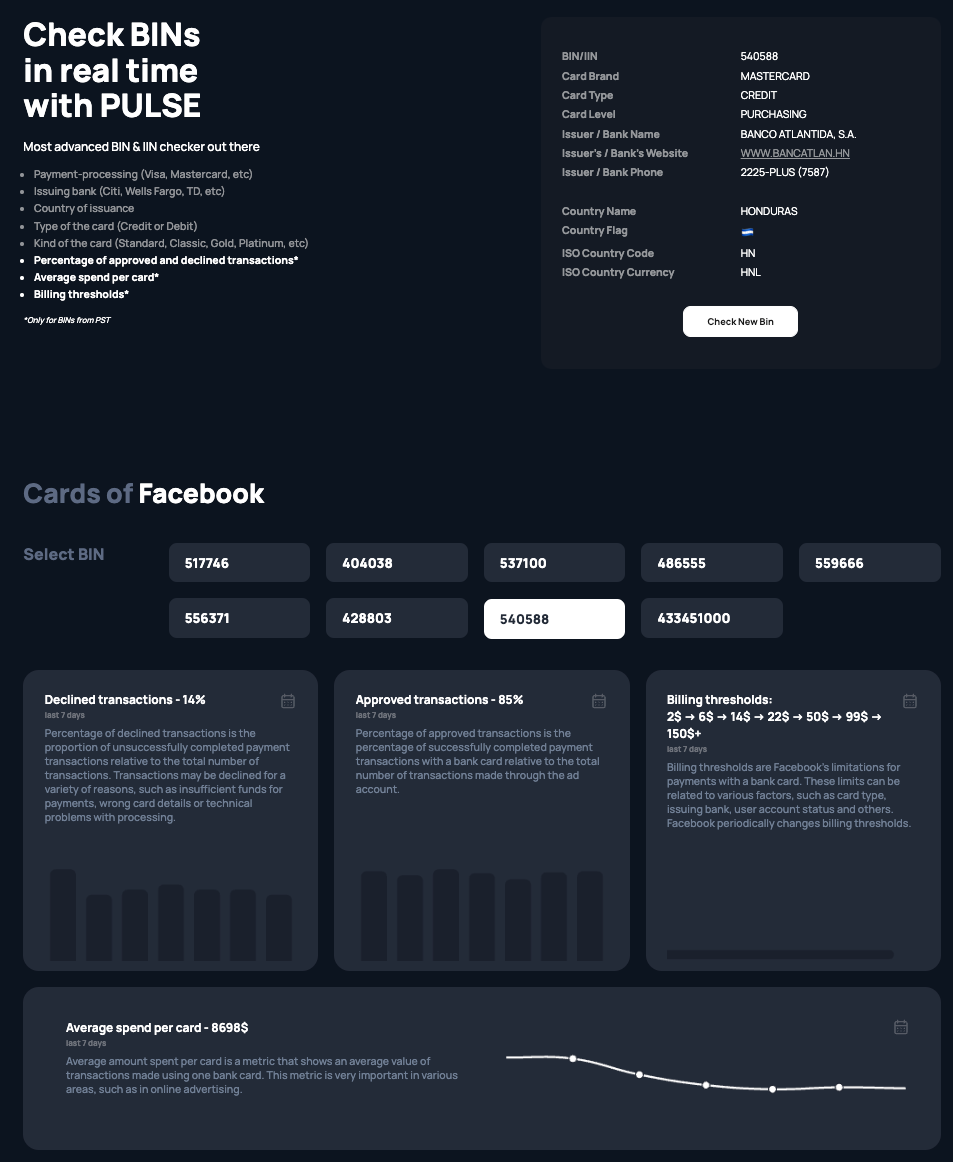

BIN identifiers may serve not only as a basic provider of payment cards data. There are unique BIN checkers like Pulse from PSTNET that can show billing thresholds, rates for declined and approved transactions or even payment card trust level for major advertisement platforms, which plays a crucial role for affiliate marketers.

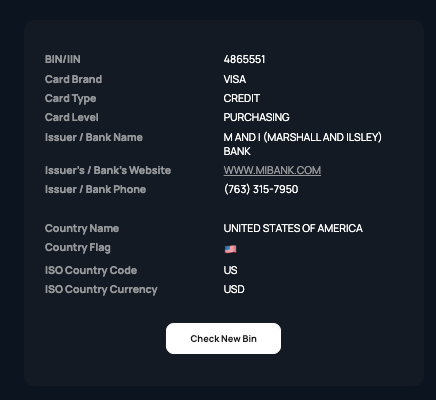

3.1 Determine the issuer of a card

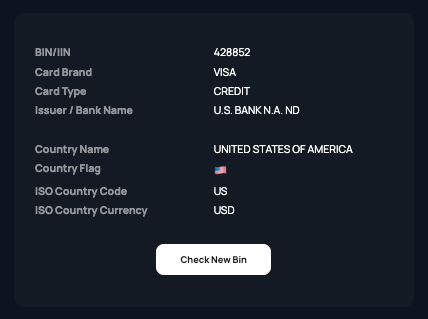

Almost all BIN code checkers provide the information about the card issuer. In most cases, this field is identical to “card issuer bank”. For example, for BIN 479722 the card issuer is AS SEB PANK and for BIN 428816 – U.S. BANK N.A. ND

3.2 Determine the bank that issued the card

With a BIN Checker, you can determine the bank that issued the card, which may influence your decision on whether to purchase the card or not. For example, cards issued by well-known US banks obviously are preferential to some disposable cards in terms of media buying or affiliate marketing. Thus this information is crucial for any affiliate marketer searching for a suitable payment method for Facebook Ads or any other advertising platform.

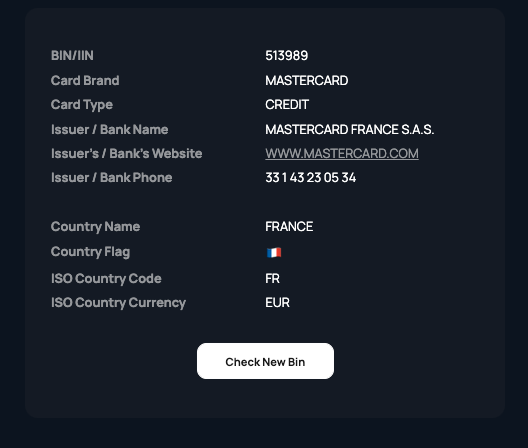

BIN 556150, issued by some organization in India will obviously be less trusted by advertising giants like Google than

BIN 513989, issued by MASTERCARD FRANCE S.A.S.

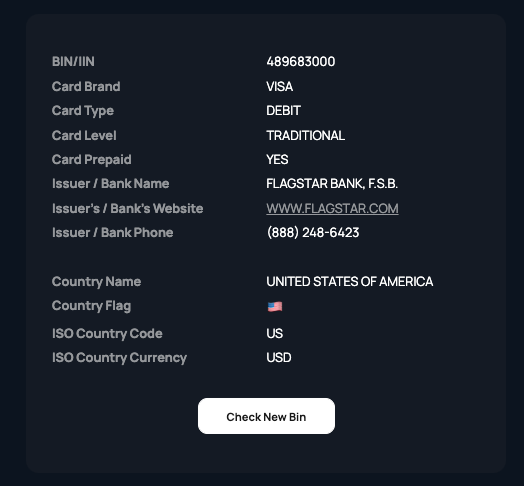

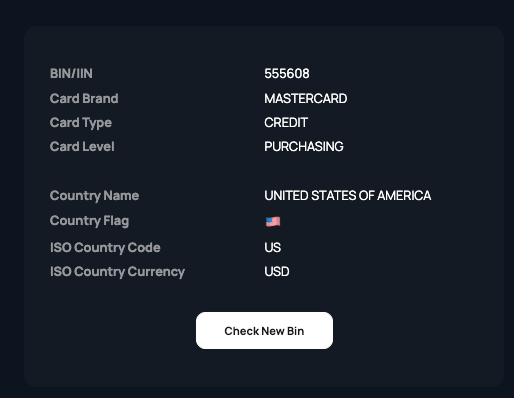

3.3 Knowing the type of card

BIN validator also helps identify the type of card, whether it is a debit or credit card, and its attributes, like payment network (Visa/Mastercard etc). Why is it important to understand the card type? For example, cards with Platinum Credit status are far more trusted in terms of risk payment bans.

There are two card types (debit and credit) and multiple card levels, including corporate ones. For example, cards with BIN 531367 are Mastercard Credit and have the level of DEBIT BUSINESS PREPAID WORKPLACE BUSINESS TO BUSINESS, which means that you can load them with a specific amount of money to ease the corporate payment process for your employees. Cards with BIN 41221688 have Visa Debit Business status, which is higher than “Prepaid”. And Mastercard Credit cards with BIN 5371001 have “purchasing” status, which is similar to usual credit cards, but on business level. BIN 512998 has Mastercard Debit Platinum level, which adds an extra level of trust from any merchant, including advertising platforms. This is one of the many reasons to verify your BIN before choosing the right card.

3.4 Knowing the country of issuance

BIN Checker can determine the country of issuance, which can be crucial when dealing with international transactions and billing region restrictions. First thing, this is important when you are filling the billing details on any merchant website. In case your billing address does not match your card’s region – the possibility of declined transaction raises. Besides, some merchants have restrictions imposed on some billing regions, so have banks. Knowing your card region is crucial when completing successful payment online, and this is where BIN checkers come in.

Cards with BIN 523068 issued in Hong Kong might not work with some US and EU merchants, whereas ones with BIN 485932 or BIN 463389, issued by US major banks might not work at online shops which bills as Hong Kong (like Telegram Premium sometimes does). BIN 474359 points out that the card was issued by a Brazilian bank and BIN 433451000 – by ABN AMRO BANK located in Chile. Thus any purchase in a US shop will most likely be accompanied by additional international tax or some currency conversion fees. Vise versa, if you use a card with BIN 559292 or BIN 531993, which correspond to US as country of card issuance, trying to pay for ads in euro or for a pair of shoes in UK sneaker shop will add from 1% to 3% of international tax to your payment summary.

3.5 Percentage of approved and declined transactions

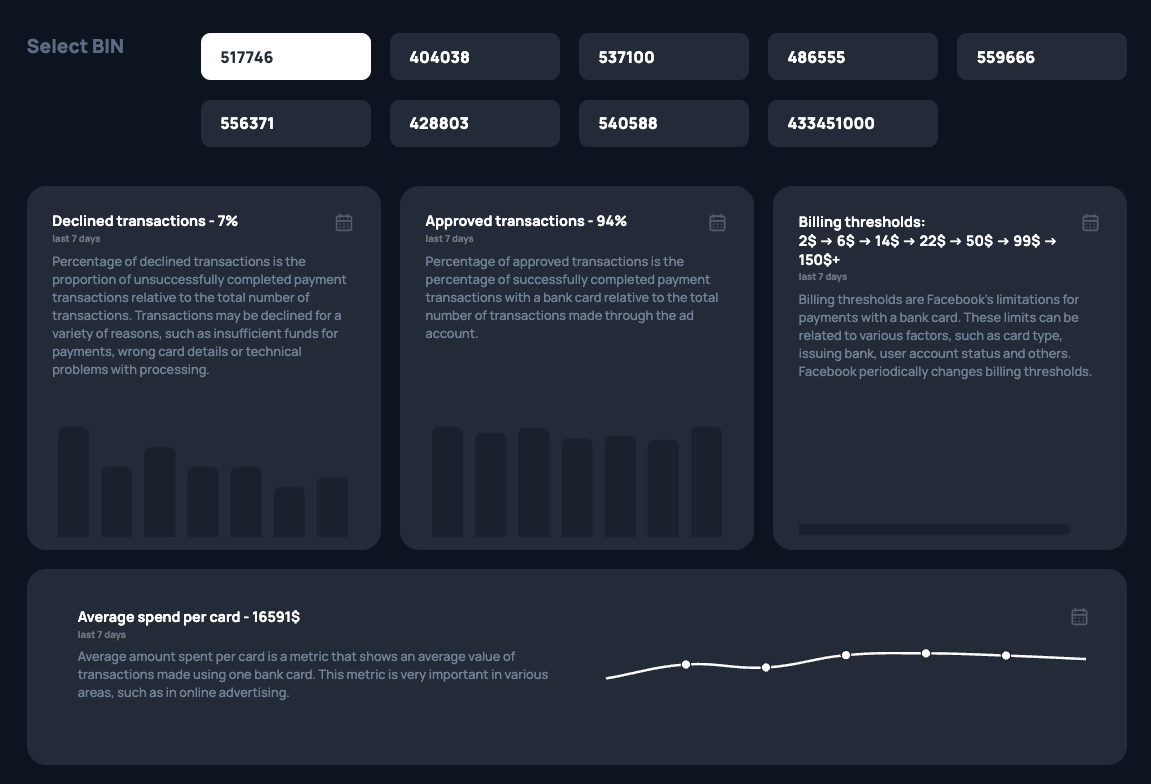

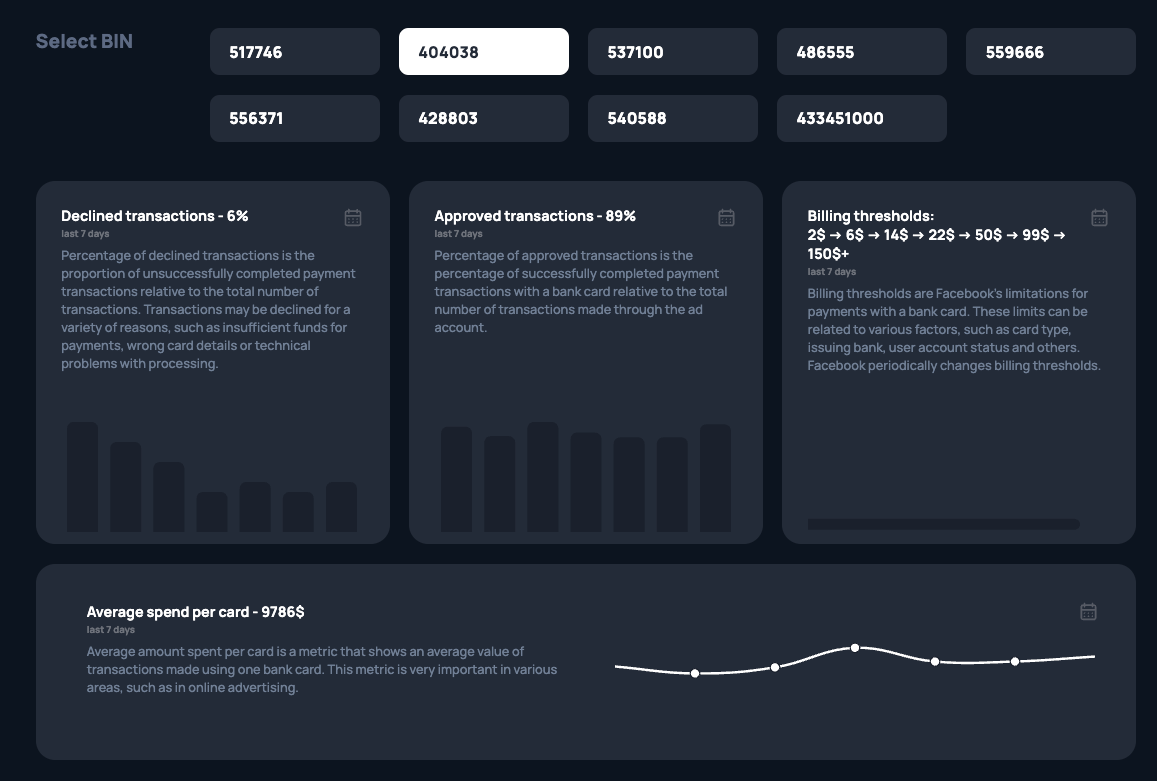

PST Pulse can provide data on the percentage of approved and declined transactions, which is important mostly to digital marketers. BIN with high decline rate is perceived as less trusted from the advertising platform’s point of view, and one with high success rate – lowers the possibility of getting your account restricted.

On the screenshot we can see detailed statistics for BIN 517746 performance on Facebook Ads. Decline rate of 7% and average spend of $16 591 in the last 7 days shows that cards with such BIN can be successfully used to run large-scale campaigns on FB.

For BIN 404038 the decline rate is avan less – 6% only. However, the average spend is less as well.

3.6 Average spending on a card

Using a BIN validator, you can determine the average spending on a card. Why is it important? Some cards have spending limits, along with restrictions on maximum one-time transactions. Knowing the average spending limits users can determine if the card with this exact BIN suits their specific payment needs.

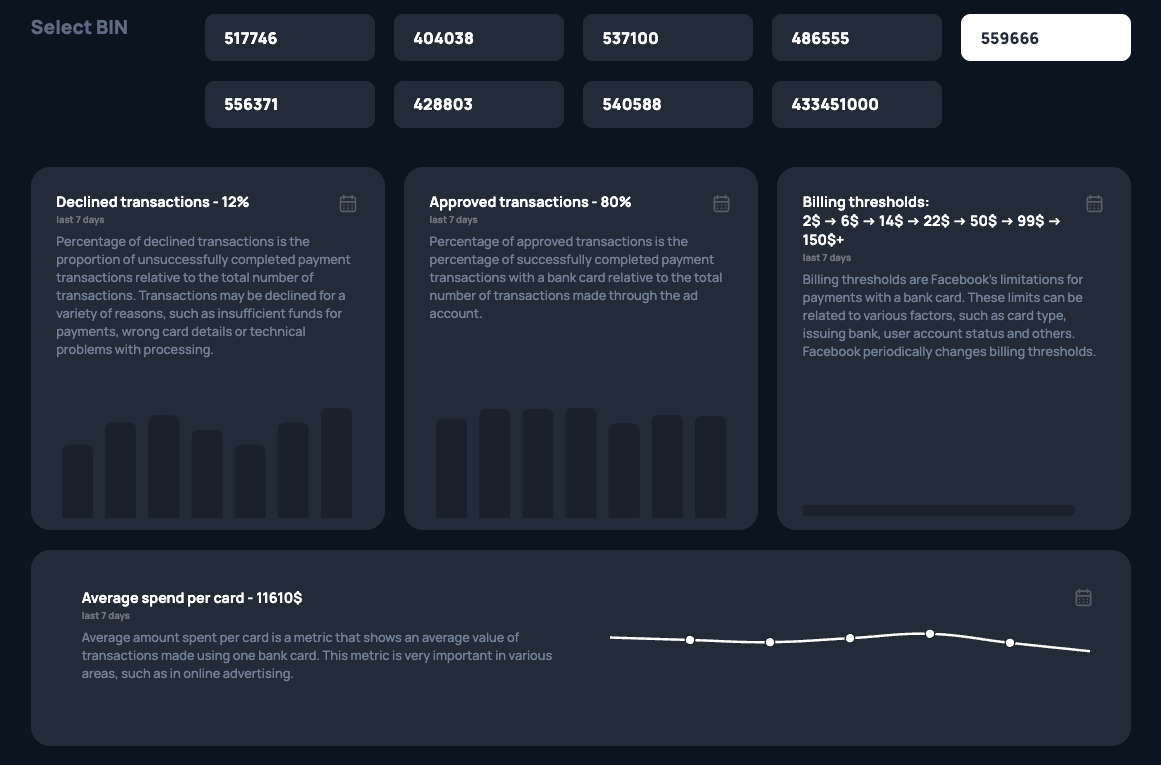

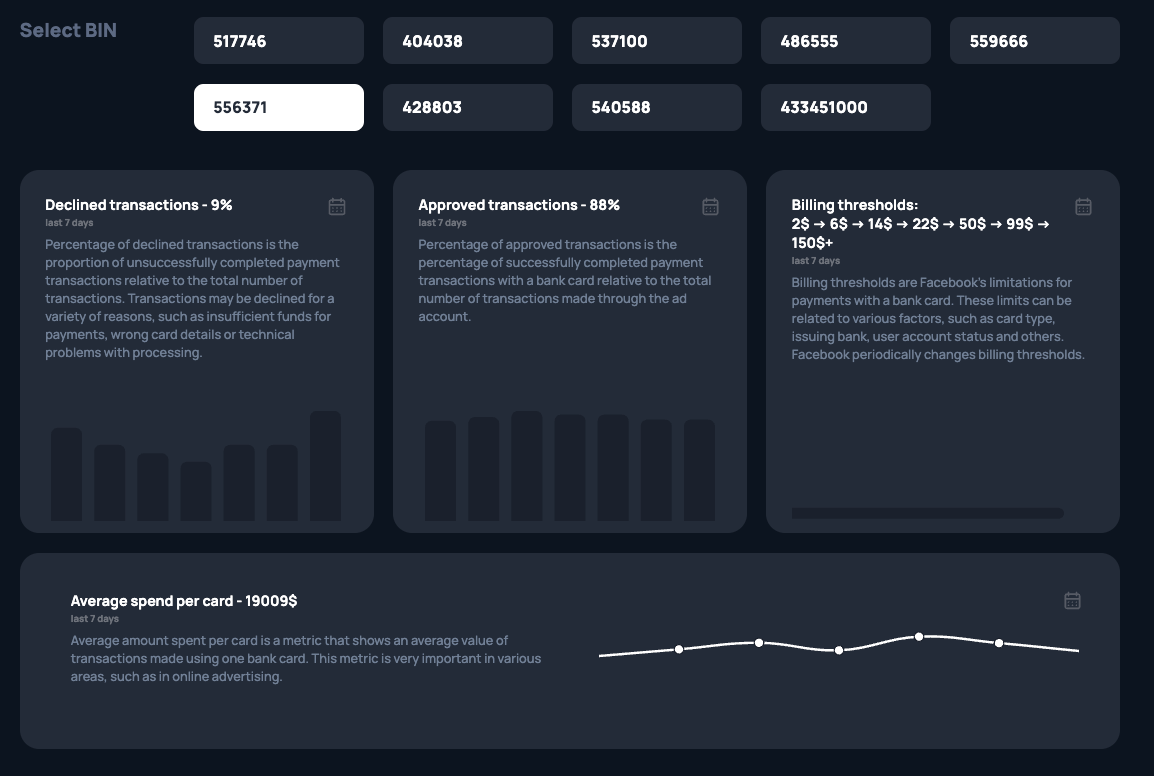

For BIN 559666 the average spend is more than $11k, and for BIN 556371 – more than $19k.

Along with other information, like decline rate and billing thresholds, we can make a data-driven assumption that these cards perform well on FB ads, keeping in mind that there are no big changes in average spending as well (see graph line on the screen)

3.7 Billing thresholds

So far none of the BIN code checkers except PST Pulse can provide information on billing thresholds, which can be helpful when setting up recurring payments or subscriptions. This is one more important thing to digital marketers, as, obviously, it is more convenient to pay one $500 bill to Facebook or Google ads, than counting all $5 transactions in your financial report at the end of the month.

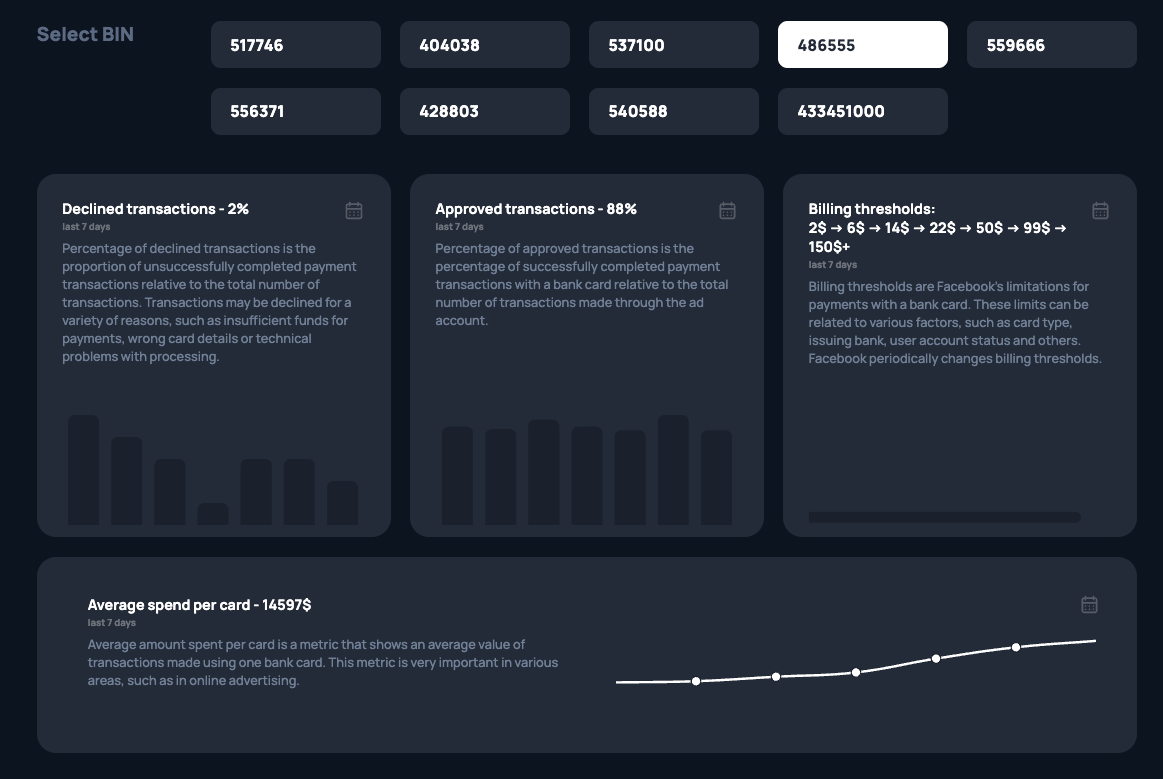

Billing thresholds – one more important characteristic to look at – shows that for these cards usual thresholds are more $150, which assumes a significant level of trust from FB ads towards BIN 486555.

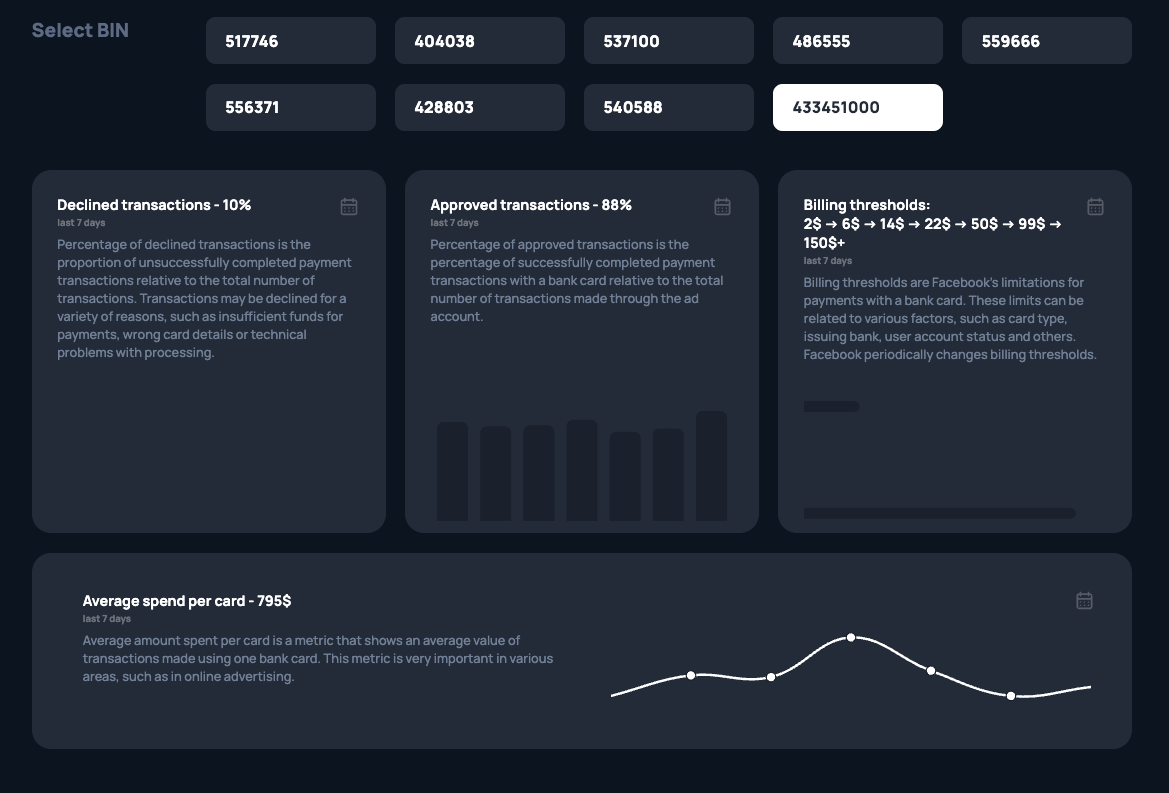

For BIN 433451000 we can see more variability in billing thresholds and quite little yet varying average spend, so this BIN is much likely new, thus not associated with any shady activity on advertising platforms.

4. BIN Checker PSTNET

PSTNET offers an advanced BIN Checker that provides users with accurate basic information about any card, like card issuing bank and country. And for cards from PSTNET, Pulse BIN Checker shows data on billing thresholds, decline rate on Facebook and Google Ads separately, which make it one of the best BIN checkers on the market – an essential part of a digital marketer’s toolbox.

Using PST Pulse digital marketers can seamlessly get all the necessary info for BINs like BIN 428803 or BIN 540588.

5. Description of the main functions of a bin checker

The main functions of a BIN Checker include verifying the validity of a card's BIN number, identifying the issuing bank, card type and status. BIN Checkers are essential tools for merchants and advertisement professionals to ensure secure and reliable transactions.

Using a card with BIN 539406 or BIN 519075, issued by US banks will get you a higher level of merchant’s trust while completing the transaction. And cards with BINs 459851 or BIN 537361, issued in the UK will help you avoid international transaction fees at UK-based merchants.

6. How to use a BIN Checker?

Using a BIN Checker is a simple and straightforward process. All you need to do is to enter the first six to eight digits of your card number into the BIN Checker tool. The tool will then provide you with accurate and timely information about your card's BIN number.

7. How to interpret the results

After conducting a BIN number check, how should one interpret the results? That is pretty straightforward as well. From basic info, like card issuing bank, location, card type and status one can understand whether the card will work on the necessary merchants or in certain billing regions.

From the extended info like the percentage of approved and declined transactions, billing thresholds, acquired on a specific BIN Checkers like PST Pulse, digital marketers, media buyers and other professionals can get all the necessary information to streamline the financial side of their business processes.

Looking up this info and verifying BINs are not that hard. Here, try by yourself:

BIN 518060

BIN 533627

BIN 553371

BIN 557079

BIN 558202

BIN 558419

BIN 51806208

BIN 51807095

BIN 51807117

BIN 51807141

BIN 51807143

BIN 51807383

BIN 51807385

BIN 51807389

BIN 52384105

BIN 52780717

BIN 52780785

BIN 53043146

BIN 53043164

BIN 53043175

BIN 53043179

BIN 53060361

BIN 53060367

BIN 53060386

BIN 53060795

BIN 53064978

BIN 53067394

BIN 53067660

BIN 53067685

BIN 53067870

BIN 53088301

BIN 53088392

BIN 53162004

BIN 53162117

BIN 53162150

BIN 53162181

BIN 53162194

BIN 53162199

BIN 53162295

BIN 53162336

BIN 53162360

BIN 53162715